straight life policy formula

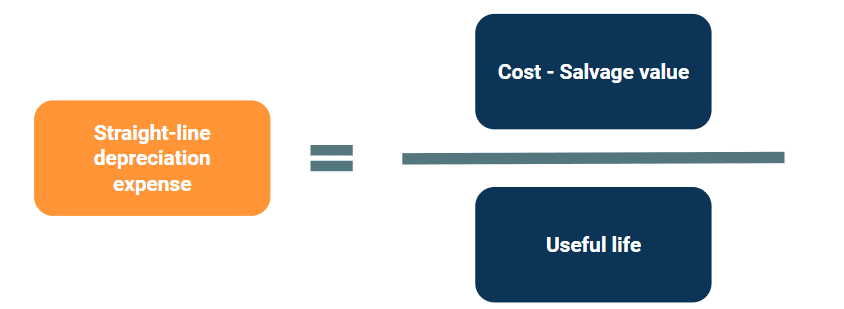

The formula first subtracts the cost of the asset from its salvage value. The straight-line method of depreciation posts the same dollar amount of depreciation each year.

What Is A Straight Life Policy Bankrate

On the death of the.

. Formula for calculating Straight line depreciation method is as under. The depreciation amount is the same every year. The straight-line depreciation formula is.

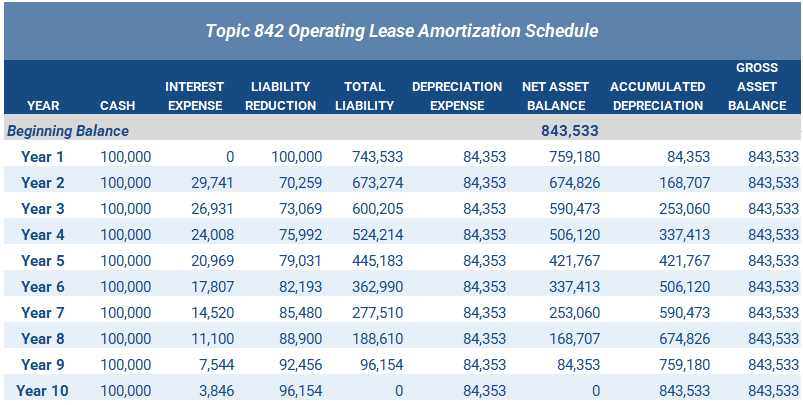

The straight line calculation steps are. Straight Life Annuity. It is calculated based on the fiscal years remaining.

Divide the product by 12 to calculate your monthly straight life benefit. Depreciation Value of Asset Salvage Value Life of Asset Value of asset is the value at which the asset is recorded. Every calculation for other payment options.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable. A straight life insurance policy often known as whole life insurance has a cash value account. In year one you multiply the cost or beginning book value by 50.

Cost - Residual Value Useful Life. Acquisition cost Salvage value Service life years. A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a.

If the formula provides 30 per month. This is expected to have 5 useful life years. Straight line depreciation can be calculated using the following formula.

Straight line depreciation method charges cost evenly throughout the useful life of. To calculate an assets value you need to know the straight-line depreciation formula and how to apply it. The Straight Life Option.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over. This policy can be used as an estate planning. The straight life option pays a monthly annuity directly to the retiree for life.

Determine the cost of the asset. Calculate your annual straight life pension using your pension formula. It is calculated based on the fiscal year which is defined by the fiscal.

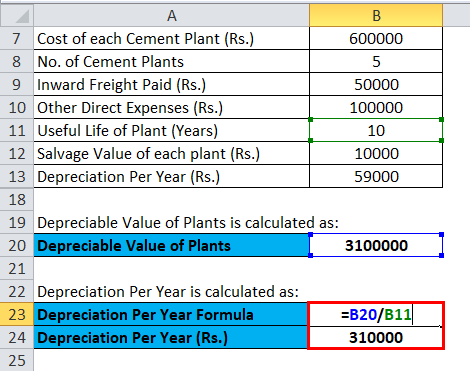

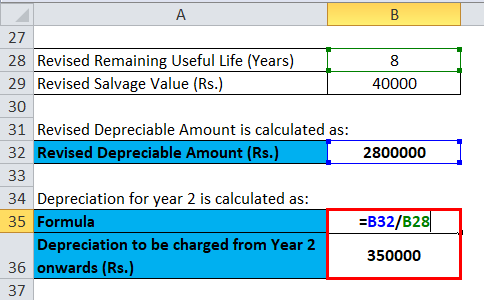

Examples of Straight Line Depreciation Formula With Excel Template Lets take an example to understand the calculation of the. If you select Fiscal in the Depreciation year field the straight line service life depreciation is used. For more information please see our.

CEO The Annuity Expert. Straight life policy formula Friday February 11 2022 Edit. Straight life insurance is a type of policy that pays out a benefit to the policyholder upon their death.

A straight life annuity is an annuity that pays a guaranteed stream of income but ceases. Subtract the estimated salvage value of the asset from the cost of the asset to get the total. For single employees the required form of payment is a straight-life annuity which typically provides a monthly payment based on the plan formula.

Straight life is the simplest benefit option offered by APERS.

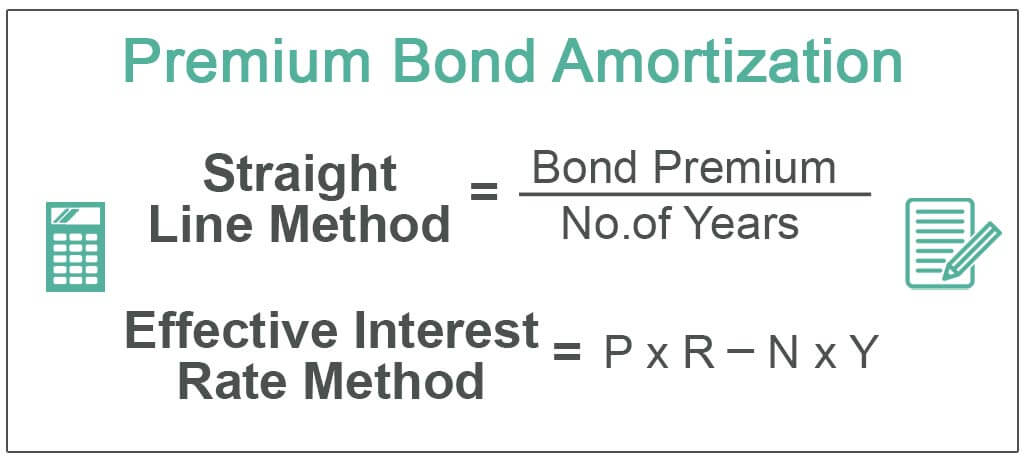

Amortization Of Bond Premium Step By Step Calculation With Examples

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula Guide To Calculate Depreciation

How Much Life Insurance Do I Need Nerdwallet

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

Straight Line Depreciation Formula Calculator Excel Template

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

How To Calculate Premiums On A Whole Life Policy

Straight Line Depreciation Formula Calculator Excel Template

Annuity Payout Options Immediate Vs Deferred Annuities

The Complete Resource For Straight Whole Life Insurance

What Is A Straight Life Policy Bankrate

Straight Line Depreciation Method Explained W Full Example

How Much Life Insurance Do I Need Nerdwallet

12 Rules For Life An Antidote To Chaos Peterson Jordan B

Life Insurance Calculator How Much Do You Need Forbes Advisor

Joint And Survivor Annuity The Benefits And Disadvantages

Straight Line Depreciation Template Download Free Excel Template